Harley Davidson Financial Analysis

Financial ratios and metrics for Harley-Davidson Inc.

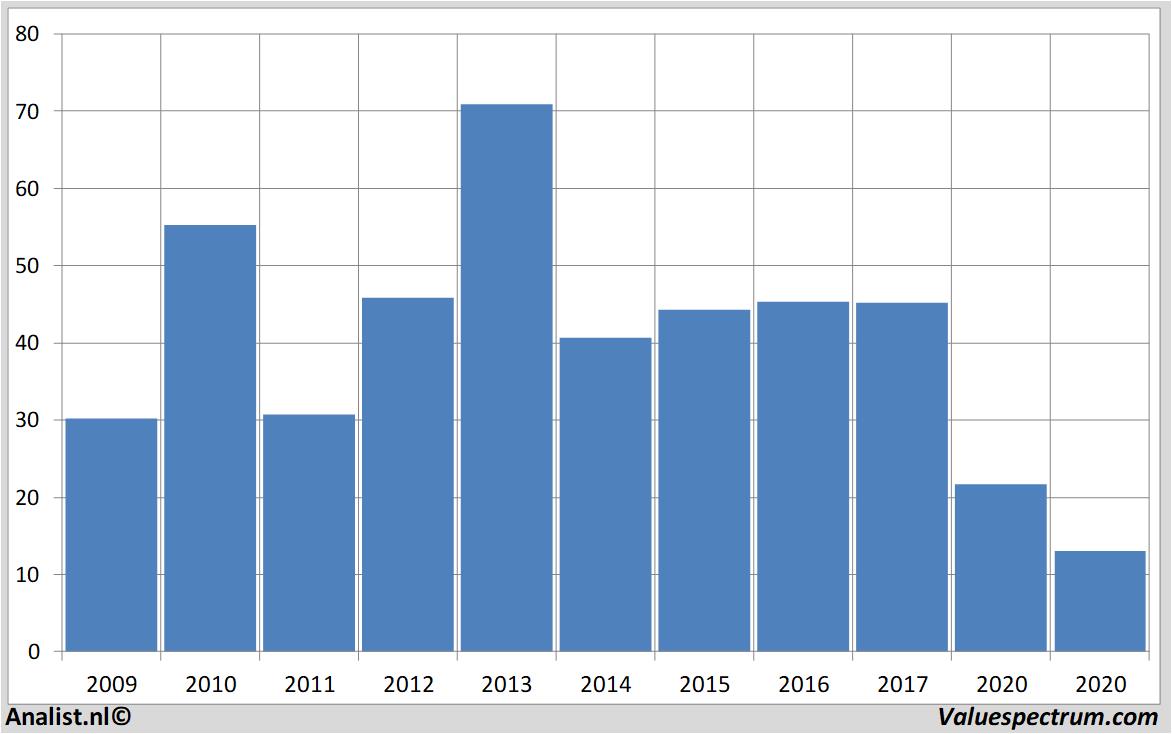

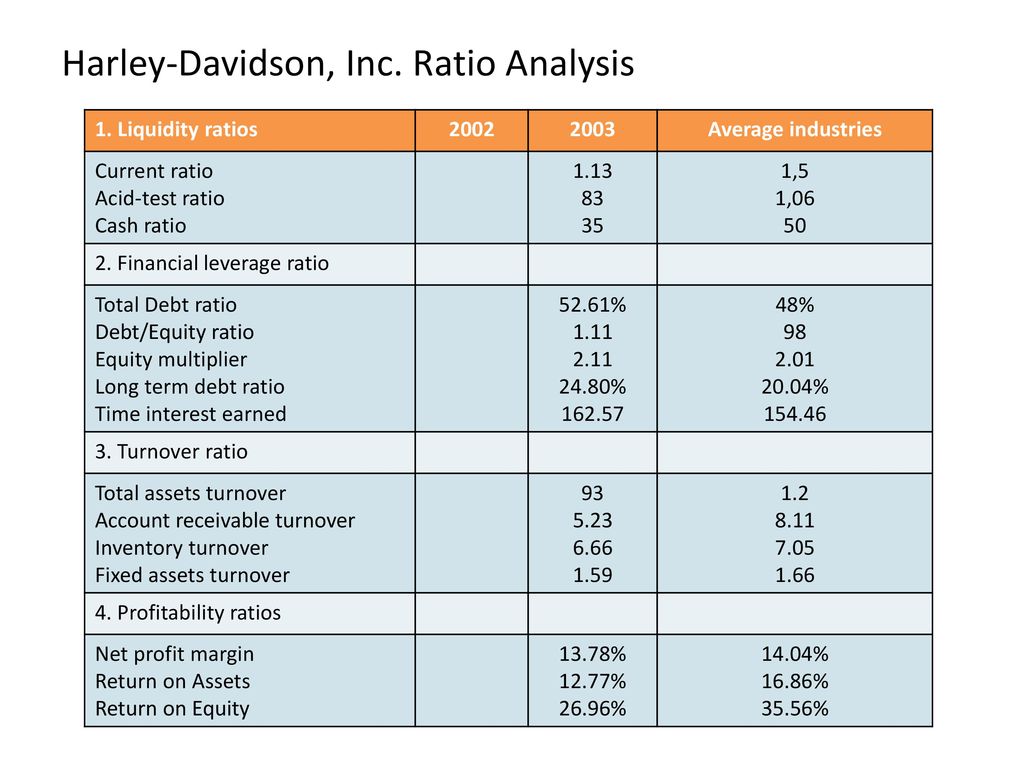

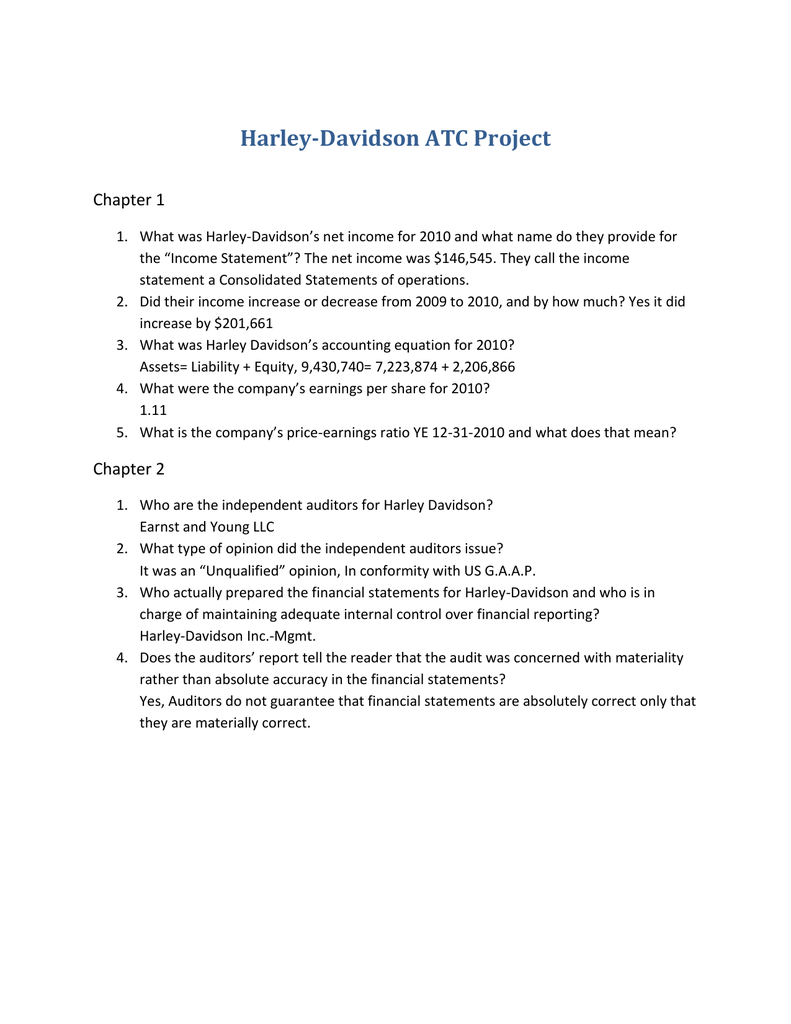

Harley davidson financial analysis. Discounted Cash Flow Model. Includes annual quarterly and trailing numbers with full history and charts. First we have found that Harley is a highly liquid company.

Engages in the production and sale of heavyweight motorcycles. HARLEY-DAVIDSON INCs gross profit margin for the second quarter of its fiscal year 2021 is essentially unchanged when compared to the same period a year ago. The EVEBITDA NTM ratio of Harley-Davidson Inc.

Its consistently high current and acid-test ratios prove that in the short run the company is in a strong position to meet its obligations which would be especially useful in the case of another economic downturn. - Financial and Strategic Analysis Review Publication Date. Performed a ratio analysis of the financial performance of two competitors and compared them to H-D.

We have conducted a comparative analysis of the balance sheet and the income statement of Harley-Davidson Inc. Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc. The EVEBITDA NTM ratio of Harley-Davidson Inc.

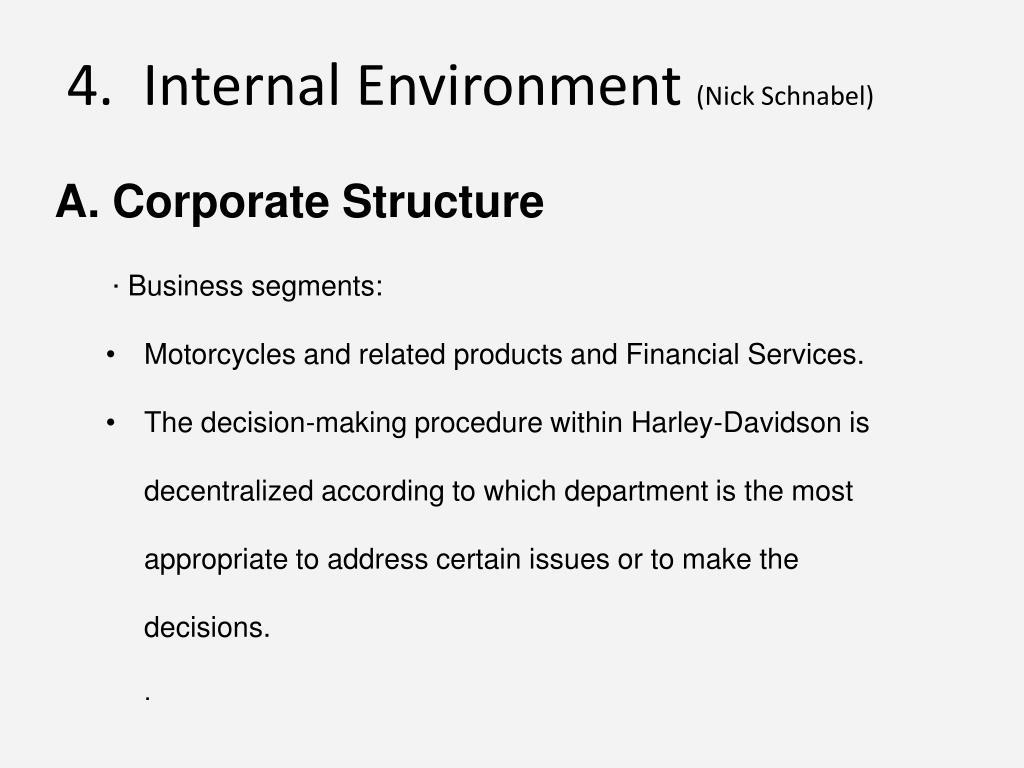

Hereafter the Company for the year 2020 submitted to the US. Securities and Exchange Commission SEC. The Motorcycles Related Products segment and Financial Services.

Harley consists oftwo segments. The primary business activity of the company is Motorcycles Bicycles and Parts SIC code 3751. EBTEBIT The companys operating income margin or return on sales ROS is EBIT.